The epilogue to the state program to rescue Aegean from the large... air gaps caused by the pandemic was written yesterday, as it became clear that the state will lose almost 35 of the 120 million of compensation granted to the carrier to cover the damages of the pandemic. This was not the only aid that Aegean received from the state. However, figures presented today by BD show that compared to other European countries, the Greek State gave small amounts of money to support the country's dominant carrier.

The main state aid to Aegean, €120 million, was not given as part of a recapitalisation, as was the case with other European airlines (including Lufthansa), but as a direct grant to cover the damage caused to the carrier by the restrictive pandemic measures taken in 2020. Such grants were allowed by the interim regulation on state aid during the pandemic period and were approved for five other European airlines, including the Portuguese TAP and Alitalia.

Aegean, in order to 'unlock' this State benefit, undertook two commitments:

- First, to complete a capital increase for private shareholders to contribute €60 million,

- Accept the issuance of warrants that would allow the State to acquire 10,369,217 new Aegean shares (10.3% of the share capital) at the same, low price as the shares issued to private shareholders during the 2021 capital increase, i.e. for €3.2 million.

This was the solution found in order to 'tread' the Aegean rescue plan in two boats: on the one hand, not to give a 'net' grant that would not be repaid, on the other hand, not to issue shares in favour of the State and raise the issue of partial nationalisation of Aegean. Moreover, if it were aid in the context of recapitalisation, the Commission would have examined the authorisation more strictly and would probably have imposed conditions on Aegean similar to those imposed in other similar recapitalisation programmes (reduction of routes, allocation of slots to competitors).

The warrants in favour of the State were, according to the law, counterbalanced by a right for the company to avoid the State's entry into its share capital. Aegean would have had the right to buy the new shares from the State at a price calculated on the basis of the current value of its share (weighted average price of the last 60 days before the exercise of the State's option) minus EUR 3,2, which was the price of the capital increase.

The missed opportunity for the State to get back the EUR 120 million

Through this procedure, a 'window' was opened for the State to be able to recover part or all of the EUR 120 million it had offered as a sponsorship to the company, provided that the price of Aegean's shares increased accordingly. In other words, a rescue programme for the country's dominant carrier could be completed without taxpayers incurring losses.

In fact, the long period of time allowed by law for the State to exercise the right to issue new shares also pointed in this direction, i.e. to cover the costs of the rescue programme through the strengthening of the share price. The State had the right to exercise the warrants after the second year and up to 5 years from the date of payment of the EUR 120 million, which was 3 July 2021. That is, until July 2026, a period long enough for Aegean's valuation to strengthen enough to increase the State's compensation for the acquisition of its shares accordingly.

However, as of yesterday, it became known that the State has already, as of November 3, rushed to declare to Aegean its intention to exercise its rights. According to the calculations made public by Aegean, the basis for the transaction will be the price of EUR 11,43 (minus the EUR 3,2 which was the price of the increase). Thus, the State will receive EUR 85,4 million and a loss of EUR 34,6 million will crystallise from this State aid.

The government has chosen to proceed now with the exercise of its rights at a time when Aegean's share price has more than doubled this year, while the outlook for the economy and tourism in the coming years indicates that there is the potential for the company to continue its strong upward trend. According to Beta Financial's calculations, if the State waited until the share price rose to 15 euros (which seems not unlikely to happen until July 2026, when the warrants expire), the State would receive 122.35 million euros from Aegean and would make a small profit from the transaction, instead of the loss of 34.6 million euros.

The "silent" aids

In any case, however, the support package given by the State to Aegean was much larger than the EUR 120 million in state aid, which was the only aid that had to be approved by the Commission under the State aid regulation. The EUR 120 million, together with the EUR 60 million from private shareholders, provided a valuable capital cushion at a time when Aegean's losses were burning through its capital at a dangerously fast rate, but the company's operations were saved with working capital thanks to the State's guarantee for a large loan of EUR 150 million. This loan was granted as part of a broader programme to provide liquidity to businesses during the pandemic, and therefore did not require specific approval from the Commission.

This loan has already been repaid, prematurely. As the Company reports in its first half financial statements, "in October 2020, the Company signed a contract with the four Greek systemic banks for a EUR 150 million floating rate bond loan (3M EURIBOR + margin), using the financing program of the Covid-19 Enterprise Guarantee Fund, in the form of a guarantee mechanism of 80% of the nominal value of the loan, maturing in 2025. In March 2023, the Company repaid the bond loan in full."

However, the state support for Aegean does not stop here. The company received substantial aid, one of the largest under this programme, from the SYNERGY programme, through which the State paid the salaries of staff temporarily on leave. Aegean (like many other companies) made use of the State's horizontal employment support measures (Suspension and Co-operation Programmes), using the possibility of suspending contracts for about 70 % of the workforce. From June 2020 until the end of the year 2020, use of the Co-Work program was made for 55%-70% of the workforce, depending on the operational needs each month. Thus, with government assistance and employment support measures, Aegean was able to reduce personnel costs by 42% in 2020.

Also, Aegean was the main beneficiary of a measure that applied to all airlines during the pandemic: in violation of the relevant European regulation, the government allowed airlines not to refund the money of those who had tickets for flights that were postponed, but to give them vouchers to travel in the future. Later, of course, the government later abolished this facility for airlines before the Commission intervened to check the violation of the regulation, but for a significant period Aegean, like other, much smaller airlines, was financed by its customers without interest.

Record of earnings

After this multifaceted state support and by leveraging the strong dynamics of Greek tourism, Aegean has managed to leave the huge losses of 2020 far behind and achieve record financial results. It is noteworthy that the first half of 2023 was the first profitable first half in its history (always due to seasonality, the first half of the year the company was making losses) and even the pre-tax profit reached 48.6 million euros. Confirming, in fact, that the company has not only stopped "burning" capital, but instead is dynamically strengthening its capital base, Aegean showed in its consolidated balance sheet capital of EUR 363.7 million on 30/6/23, up 70% compared to 1/1/2022.

The European ranking

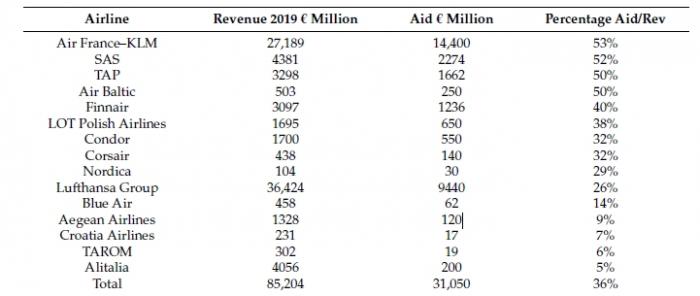

In the big picture of state aid given to airlines in Europe, the €120m given as aid to Aegean does not seem excessive. According to a study published by economists Luis Martín-Domingo and Juan Carlos Martín, recording aid as a percentage of airline revenues in 2019, Aegean seems... unfair, since the €120 million it received represented 9% of its revenues, while there were four airlines with percentages of 50% or more, led by the Franco-Dutch Air France KLM, with 53%. Relatively limited as a percentage of revenue, although the absolute amounts were very large, was the aid to Germany's Lufthansa 26%.

State aid as a percentage of airline revenues in Europe

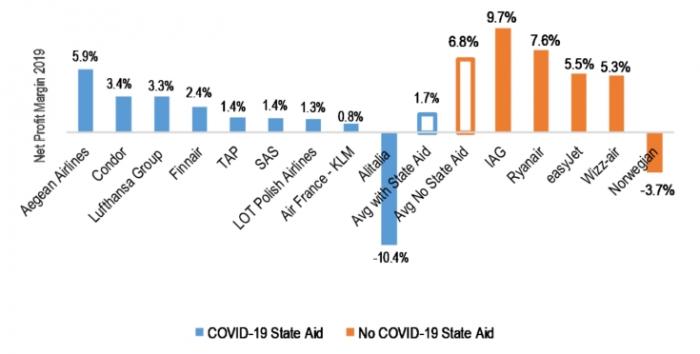

An interesting fact recorded in the same study is that Aegean entered the 2020 pandemic in a better position than all other European companies that received state aid. Its net profit margin in 2019 was 5.9% and was by far the highest in Europe. Lufthansa was in third place, at 3.3%, while Alitalia was already deeply loss-making.

The net profit margins of European airlines before the pandemic

The action brought by Ryanair

While this adventure for Aegean and the Greek state is coming to an end, a legal "tail" remains that is not entirely unlikely to cause a reversal. Irish Ryanair, always out of the state aid game, has challenged almost all state aid schemes approved by the Commission in the European Court of Justice in 16 different appeals. Among them, the state aid to Aegean. The procedure before the European Court of Justice is not yet completed and its decision is awaited, but already in some cases (including the case of state aid to Lufthansa) Ryanair has been vindicated at first instance.