The issue of the losses incurred by the Greek State from the recapitalizations of banks was again brought to the surface by an analysis of the KEPE entitled: "The unseen side of the moon: The negative impact of the HFSF's disinvestment from the Greek banking system", which puts the losses at between €42 billion and €43 billion.

According to the analysis of the KEPE, the Hellenic Financial Stability Fund (HFSF) "has cumulatively supported Greek banks with 46 billion since 2011", of which "the bulk of this upper amount directly or indirectly concerns the four systemic banks."

KEPE points out that for the State to receive its money back, the market value 'of the four systemic banks would have had to be 1,383% higher than that on 6/10/2023. That is, about 14.83 times higher". Based on the current values of the banks, the CPE concludes that the HFSF's losses from the disinvestment "amount to between EUR 42 billion and EUR 43 billion, or alternatively the implied return is between 91.3% and 93.5%".

The KEPE emphasises that the "central objective of the above assessment should be practical and should result in policy recommendations on what initiatives could have been taken, given the constraints imposed by the economic situation, in order to avoid similar damaging actions in the future for the Greek public sector".

Indeed, the KEPE goes on to compare bank rescue programmes in other countries, such as the US and the UK, noting that the US made a profit of +13.7% from the TRAP programme's investment in banks, while the UK incurred small losses from the bailout programme of -17% of the initial investment.

The analysis of the KEPE comes at a time when the strategy of disinvestment of the State from the banks is underway, a move necessary for the definitive return of Greek banks to European normality, and with several voices calling for the timing of the disinvestment to be postponed in order to reduce the losses of the State.

At the same time, the glittering conclusion of the KEPE on the losses of the State of 43 billion euros gives new fodder to various irrational approaches to bailing out the banks with a pile of state billions, theories that are shared by a large part of the political staff from all parties.

The unseen side of the moon

And while the KEPE's analysis may claim to present the 'unseen side of the moon for the losses of the State', the conclusion of losses of 42 to 43 billion is a superficial approach based on a completely simplistic and crude accounting involving only one arithmetic operation: the deduction of the current value of the banks from the total amount of recapitalisations. In other words, 3 billion minus 46 billion equals -43 billion.

Indeed the total amount injected into the banking system, through recapitalisations and reorganisations, was EUR 46 billion, but this was mainly the result of the failure of the State and the non-payment of bonds.

The Greek government forced domestic banks to participate in the PSI, and the -53.5% bond haircut. As a result, the banks suffered a loss of -37.7 billion euros from the reduction in the value of the government bonds in which they had invested depositors' and shareholders' funds. In other words, the State 'took' EUR 37,7 billion from the banks' balance sheets as part of the debt reduction agreement.

The unimaginable loss of EUR -37.7 billion due to the PSI resulted not only in the loss of all the capital of the banks' shareholders but also in the banks' negative equity of EUR -15 billion, making it absolutely necessary to recapitalise the sector in order to remain viable and not to lose the citizens' deposits.

And any comparison with the bank rescue programmes in the US and the UK is completely inappropriate, as these were implemented because of dead-end financial problems of the banks due to decisions of the administrations and not due to national bankruptcies, as was the case with the bankruptcy of the Greek State and the gigantic losses caused to the banks by the PSI.

Thus, if the 37.7 billion that the state received from the banks through the 'haircut' of the bonds is deducted, the 'net' capital support from the state to the banks is reduced to the less flashy figure of 8.3 billion euros.

In addition, there are two other unseen dimensions that have not been particularly highlighted in the public debate and are linked to additional damage unintentionally caused by the state.

Billions of profits for the public sector from ELA

The one unseen dimension is the contribution of the banks' ELA to the profitability of the Bank of Greece, a profitability that is mostly attributed to the Greek State, a point highlighted by the Governor of the Hellenic Bank of Greece, Yannis Stournaras, speaking at the Ideas Circle last Tuesday.

The PSI, the downgrading of the Hellenic Republic's credit ratings to junk status led to the loss of domestic banks' access to ECB funding at a time when deposit outflows were huge. The only Eurosystem tool was the emergency ELA financing procedure, but this is counted as national debt and is granted (subject to ECB approval) by the Bank of Greece and carries a much higher interest rate than regular ECB funding.

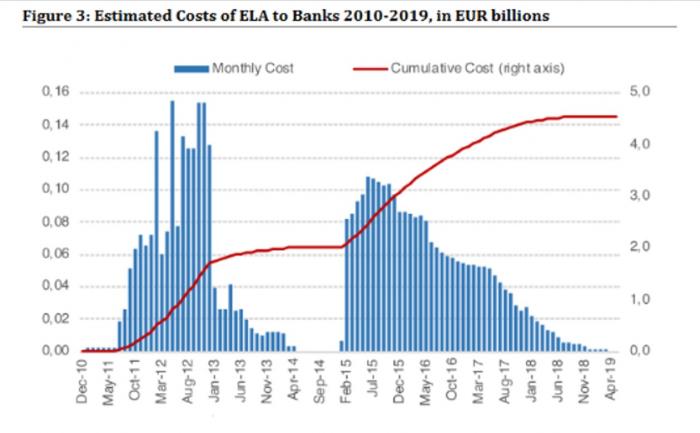

ELA to Greek banks started to be granted in 2011. It peaked at 123 billion in November 2012, fell sharply in 2014 (due to the general improvement in the Greek economy) and then soared again in 2015, peaking at around 90 billion in June 2015. Four more years were required and by the first half of 2019 all remaining ELA had been repaid by banks.

The total cost to banks throughout this period, i.e. the interest paid to the Bank of Greece for ELA, is estimated at €4.5 billion! This 4.5 billion is the extra money that the banks paid because they were drawing funding from the ECB.

If the amount of ELA interest (which boosted the state coffers) is subtracted from the 8.3 billion of state aid (without the PSI) then the net state aid to the banks shrinks to 3.8 billion, i.e. as much as the state will receive from the sales of bank shares by the HFSF.

This interest led to a more than doubling and more than tripling of the related income of the BoG. The BoG's net interest income of 500-700 million (2007-2008) jumped from 1.45 billion in 2011 to 2.88 billion in 2012, to 1.4 billion in 2013 and so on due to ELA charges. Thus in 2020, the year in which banks did not use ELA (ELA was eliminated in June 2019), the KEPE's net interest income "landed" at €515 million.

The jump in interest income led to a multiplication of BoG's profitability which jumped from a level of 225 million (2008) and 284 million (2007) to 318 million in 2012, 831 million in 2013, 654 million in 2014 (a year of stabilisation and recovery of the economy), 1.162 billion in 2015, 1.092 billion in 2016, 941 million in 2017 and 657 million in 2018.

Between 2012 and 2018, the Greek government received for the budget a total profit of 6 billion from the BoG, most of which was due to the high ELA interest (4.5 billion) charged to commercial banks.

As BoG Governor Yannis Stournaras noted, the government "has taken the huge dividends from the Bank of Greece, which have been caused by ELA."

Stournaras, indirectly responding also to the analysis of the KEPE, stressed that there is a big misunderstanding reference to the money allocated by the State to the banks, underlining that the numbers circulated are wrong. "A big mistake and as Governor of the Central Bank, I have to restore the truth," he said, highlighting the impact on the banking system of the PSI and ELA..

The state contribution to the 'red' loans

The second unseen dimension to the gigantic losses to banks in the years of the crisis is linked to indirect and direct choices made by the political system that led to an unprecedented explosion of non-performing loans to 50% of total loan allocations.

At the macroeconomic level, political instability, polarisation and the undermining of the government of the day led to an unprecedented peacetime 'plunge' in the economy (-25%) with inevitable consequences such as soaring unemployment, dramatic falls in incomes, a collapse of the property market and a sharp decline in business activity. Impacts that led to many households and businesses being unable to service their obligations.

In addition at the policy level, party bite with promises of Stimulus packages, write-offs of liabilities etc. contributed decisively to the loosening of trading mores. In addition, the years-long freeze on auctions and the adoption of laws that could not be implemented by the judicial system, such as the Katseli Law, led to a large increase in strategic defaulters and to unrealistic expectations among borrowers that they would eventually be "cleared" with a very large debt haircut.

It is no coincidence that only in two sectors of the economy, banks and energy (PPC), unpaid loans and unpaid bills reached unbelievable levels, as there was a lot of political speculation with "I don't pay" exhortations etc.

Thus non-performing loans rose to an unrealistic 50% and it took a decade of efforts to clean up the bank balance sheets from this huge problem, a problem that is now managed by servicers.

There is no doubt that the growth model of banks in the 2000s was unsustainable. Without effective tools (White - Black Tiresias), lending without serious credit criteria and very aggressive policies to boost profits, the industry would have been in crisis at some point (if policies had not changed in the meantime).

However that moment did not come as in 2010 the Hellenic Republic went bankrupt, dragging everything into the abyss.