The Greek commercial real estate market has entered a new and difficult phase, after years of continuous price rises that have reduced yields and after ten interest rate hikes by the ECB, which have brought them to a record level. According to industry executives, the era of intense mobility is now giving way to a period where deals are "drying up".

Significantly, the leading real estate conference, Prodexpo 2023, which was successfully held last week, had it all but one thing: talk of new deals and investment moves in commercial real estate.

In a packed hall at the Concert Hall, the industry's leading players were heavily involved in a series of discussions on the progress made in the sector in recent years. Government officials, CEO's and analysts took the floor for two days discussing supply and demand, foreign investors, as well as existing projects.

But what was missing was a discussion on new projects coming into the pipeline. That is, the deals that will continue the positive market momentum. On stage, the statements about the next day of the commercial real estate market were particularly careful. But privately in their discussions, market players are speaking more bluntly and referring to a "freeze", which is being addressed for the first time in several years.

Although the Greek market is showing resilience to the decline in commercial real estate abroad, the latest interest rate hike by the European Central Bank, the tenth in a row and with a cumulative increase of 4.25%, seems to be seriously testing the market's resilience.

Coupled with rising property prices, strong yields are declining, as is investor appetite for new projects. "The numbers don't add up anymore," an executive of a well-known real estate developer tells BD. "Now we are closing a deal for offices with US investors and then I don't know what will happen. We don't have anything in the pipeline. There is a gap," the executive adds.

The investment equation in real estate has changed a lot in the last year. Commercial real estate in Greece is still more affordable than in other European countries, but prices have already risen to levels where profit margins are significantly reduced. According to data from the Bank of Greece, the office price index has been rising steadily year on year since the second half of 2017.

In Athens, prices rose by more than 10% in 2022. Since the first half of 2017, which was the lowest point during the economic crisis, office prices nationwide have risen by 31.4% at the end of the second half of 2022 and are now at their highest levels since 2011. Consequently, strong yields in Greece, which are the country's great advantage, are declining, while in Europe they are recovering.

The biggest change is in the logistics segment, according to data from National Stock Exchange. In warehouses, yields in Q2 fell in Greece to 7% from 7.5% in Q3 2021, while in Europe they rose to 5.04% from 4.48% in the same period.

A similar picture is seen in store yields, while in offices the market correlations with those abroad are changing, despite strong demand for green facilities. Specifically, yields in Athens remain unchanged at around 6.5% but jumped to 4.65% in Europe in Q2 2023 from 3.79% in Q3 2021, which is of course due to the large drop in prices.

The banks are thrifty

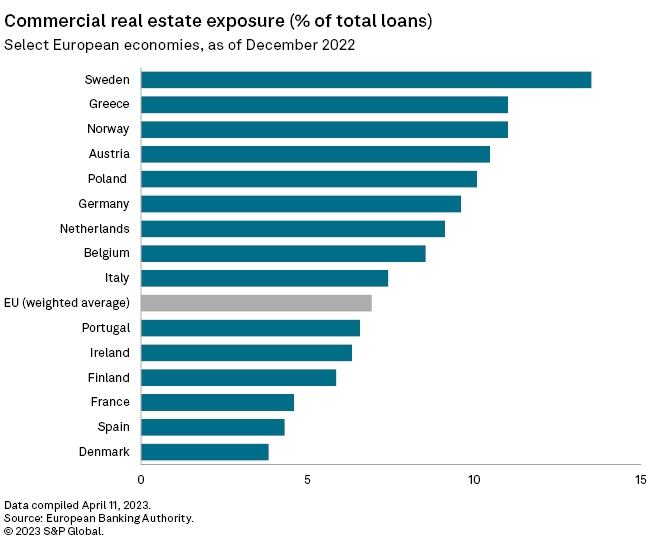

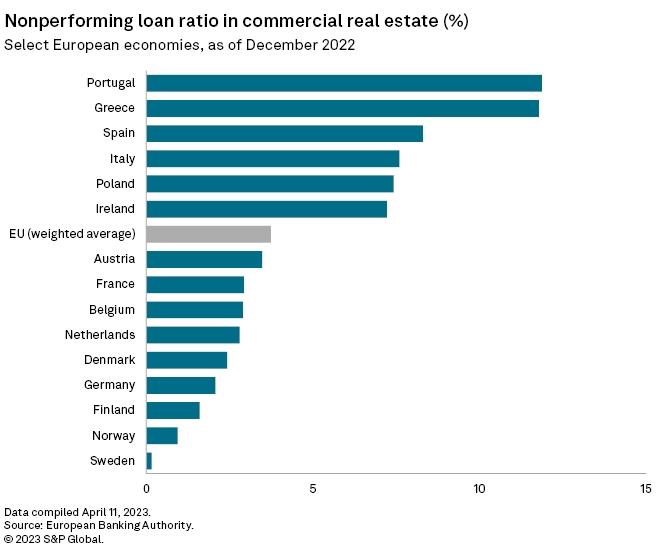

At the same time, Greek banks are now quite sparing in their financing for commercial real estate, following the trend in the eurozone banking system. Moreover, according to data published in a recent analysis by S&P Global, Greek banks have the second highest exposure to commercial real estate (commercial real estate loans as a percentage of total loans) and the second highest non-performing loan ratio in this category.

There are also "pillows"...

Despite the difficult conditions, it is not expected that the Greek market will follow the foreign real estate markets in the deep tunnel of the crisis. Both the low supply levels and the cheaper cost of project financing from the Recovery Fund offer valuable cushions to Greek assets while the economy continues on a growth path.

However, experts believe that the market is entering a downward cycle and will face challenges not seen since the country's years under the memoranda. Support from foreign investors is also weakening, especially after new geopolitical risk issues created by the war in the Middle East.

With Germany sliding into recession, there are fewer European companies expanding and seeking a home in Greece, while in times of crisis many foreign investors prefer to return to safe havens and to major markets where prices have corrected. "We are entering a difficult road with many sharp ups and downs," market circles add.