After a decade of a deep financial crisis and a creditless bounce, the Recovery Fund offers a great opportunity for banks to relaunch corporate lending and benefit from the creation of new healthy loan portfolios. The reduction of non-performing loans will help them consolidate their balance sheets but will also trim future revenues.

Top bank officials do not hide their optimism about the new growth environment that the Recovery Fund will create. Alpha Bank became the first bank to raise new funds from shareholders to support fresh lending. While informing analysts yesterday, CEO Vassilis Psaltis underlined that the Recovery Fund is not only a great opportunity for the economy, but can also bring considerable benefits to lenders.

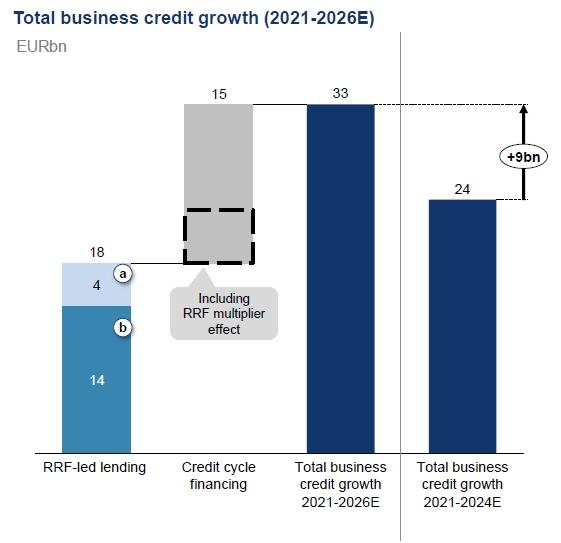

According to Alpha Bank estimates, the Fund's resources will prompt a dramatic rise in credit expansion to the business sector. As shown in the graph, banks will lend to business 33 billion euros by 2026.

To understand the boost the Recovery Fund will provide to business lending, it is suffice to say that the 33-billion-euro figure equals about 50 percent of the total non-financial lending balance in March 2021, which amounted to 66.4 billion euros, according to data from the Bank of Greece.

High Bar

The possibility, however, of a large increase in bank lending in the next five years is not an easy process that will take place automatically. Challenges lie ahead, such as:

-The rapid increase in lending requires banks to strengthen their capital base, an issue which was recently addressed Bank of Greece governor Yiannis Stournaras. With the current data, bank capital levels seem to be sufficient to cover losses from problem loans over time they will have to strengthen their capital base again, with issuance of shares or bonds, to support a large increase in loans. Alpha Bank was the first bank to recognize this need with banks expected to soon follow.

-A large increase in corporate lending demands a change in internal organization from lenders. Alpha Bank, for example, has announced that it is setting up a task force to coordinate the lending plan under the Recovery Fund, while adapting the risk assessment framework to align it with the growth prospects created by the Recovery Fund. It is also creating specialized legal and operational support functions and developing specific innovative products to be linked to the Recovery Fund, such as an investment fund that will enable institutional and private investors to invest in related projects.

Essentially, the banking system is being called upon in a very short time to turn the switch on its operations and, instead of dealing with armies of executives with non-performing loans, to turn to the promotion of investment plans that will be supported by the Recovery Fund. At the same time, capital levels will need to support growth, rather than just covering bad debt. These are major changes that will determine whether lenders will be able to provide double-digit returns on capital as being promised to investors.

NONTAS CHALDOYPIS